The Institutional Arrangements That Govern Exchange Rates Are Called the

All this is beginning to change and in this process I am glad to have played my part. This classification system is based on members actual de facto arrangements as identified by IMF staff which may differ from their officially.

The _____ refers to the institutional arrangements that govern exchange rates.

. A pegged rate means that the value of a currency is fixed relative to a reference currency and then the exchange rate between that currency and other currencies is. The oil crisis in 1971 The loss of confidence in the dollar after US. The institutional arrangements that govern exchange rates are referred to as the international monetary system.

The agreement called for a system of floating exchange rates. An insight for the government is that even if some UVRPs are implemented with a top-down institutional arrangement the government should take advantage of the role of VC in policy persuasion. The International Monetary System.

The institutional arrangements that countries adopt to govern exchange rates are known as the floating exchange rate a system the exchange rate for converting one currency into another is continuously adjusted depending on the laws of supply and demand foreign exchange market. Institutional arrangements ADB HSBC India set up USD 100 mn partial guarantee prog for MFI sector Launched in 2010 ADBs microfinance programme has provided more than USD 18 billion in loans and helped mobilize USD 881 million in co-financing. For this reason they are frequently exempted from various kinds of taxes.

49 Government units are legal entities established by. The exchange rates of all currencies are determined by the free play of market forces. View Chapter 11 - Monetary Policydocx from MGMT 405 at California State University San Bernardino.

The institutional arrangement that governs exchange rates is known as the a from BUS 187 at San Jose State University. The balance of authority between the European Central Bank ECB on the one hand and the. In a fixed exchange rate system the value of a currency is adjusted according to the day to day market forces.

Ch10 - ch10 Student. A pegged rate means that the value of a currency is fixed relative to a referencecurrency and. Its impact on international monetary relations1 The exchange rate policy of the euro area and the institutional arrangements by which it would be made were prominent among the issues addressed in this literature.

As these institutional arrangements determine to a large extent what is pro-duced what we have is a very incomplete theory. _____ jumped between 1977 and 1978. In Chapter 9 we assumed the foreign exchange market was the primary institution for determining exchange rates and the impersonal market forces of demand and supply.

Generally accepted accounting principles. All this is beginning to change and in this process I am glad to have played my part. Institutional arrangements and government performance in the Brazilian federation Victor Lledo.

Data as of June 30 2004. The Jamaica Agreement of 1976 prohibited the use of floating exchange rates in the global economy. Printed in a town called Chamalières in France by the Banque de France since 1945 the currency is used as legal tender in each of the two subzones.

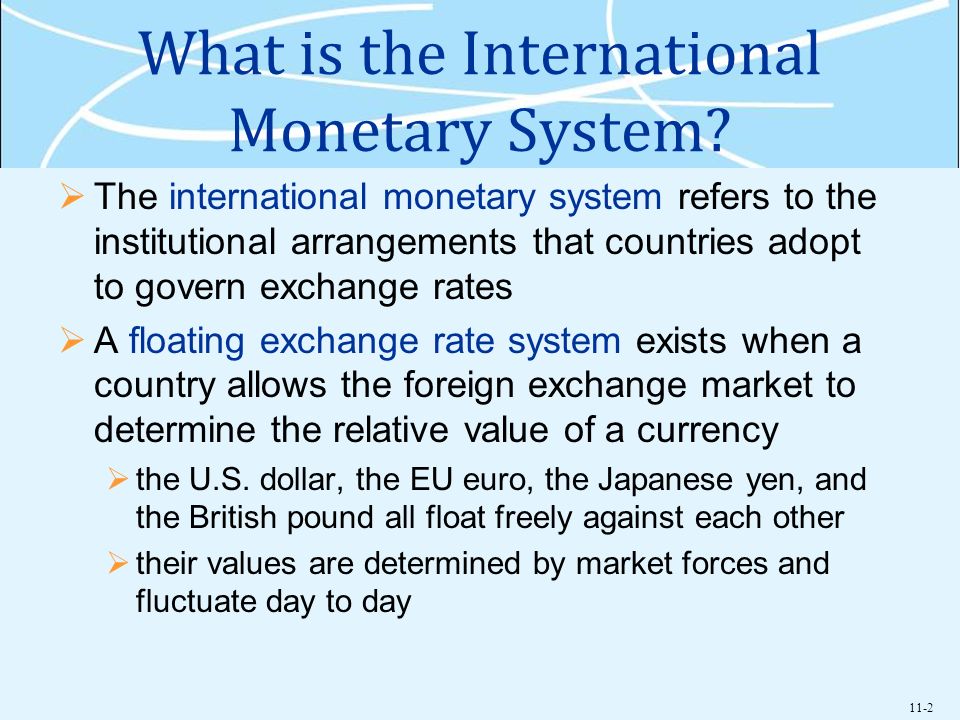

The CFA zone has several interesting featuresincluding a particular set of exchange rate arrangements and its own currency pegged to the euro. INTRODUCTION The international monetary system refers to the institutional arrangements that govern exchange rates. The value of including such.

The institutional arrangements that govern exchange rates are referred to as theinternational monetary system. The Bretton Woods agreement of 1964 established the institutional arrangement governing the global monetary system. Full PDF Package Download Full PDF Package.

Specifically the institutional arrangements which govern the process of exchange. A short summary of this paper. International monetary system.

The institutional arrangements that govern exchange rates are referred to as the international monetary system. Which of the following refers to the institutional arrangements that govern exchange rates. Exists when a country allows the foreign exchange market to determine the relative value of a currency.

Institutional units that control or manage them are not entitled to a share in any profits or other income they generate. More specifically the institutional arrangements which govern the process of exchange. 37 Full PDFs related to this paper.

The value of including such institutional factors in the. The fall of the value of the dollar between 1985 and 1988 was caused by. However the success of a bottom-up institutional arrangement depends to a large extent on the capacity transparency and democracy of the VC.

As these institutional arrangements determine to a large extent what is produced what we have is a very incomplete theory. When the foreign exchange market determines the relative value of a currency thecountry is adhering to a pegged exchange rate. The _ refers to the institutional arrangements that govern exchange rates.

Classification of Exchange Rate Arrangements and Monetary Policy Frameworks 1. The international monetary system refers to the institutional. Refers to the institutional arrangements that countries adopt to govern exchange rates.

For weak currencies. Classification of Exchange Rate Arrangements and Monetary Policy Frameworks Home Page. In this paper we study the effect of legal reforms and institutional changes on credit market development and the low level of unpaid debt in the Chilean.

Since 1973 exchange rates have become more volatile and less predictable because of. A description of the treatment of NPIs within the System is given in section C.

Comments

Post a Comment